If you are interested in applying to GGI's Impact Fellowship program, you can access our application link here.

1. Introduction

The after-effects of the COVID-19 pandemic and international political troubles have been making headlines, drawing attention towards the struggles being faced by the economy and different communities and groups in the society. Juxtaposed with this scenario are corporations in sectors like energy, food, and pharmaceuticals who have been raking in record-high profits owing to these exceptional circumstances. Oxfam research shows that the profits of food and energy billionaires have risen by $452 billion in the last two years – equivalent to $1 billion every two days.

Energy companies in particular have earned super normal profits owing to the energy price-rise emerging due to the 2022 Russia-Ukraine crisis, with five of the largest energy companies (BP, Shell, Total Energies, Exxon and Chevron) making a profit of $2600 every second. These record windfall gains have led to multiple countries like India, Italy, the United Kingdom, etc. to impose a windfall tax on the energy sector.

This paper details the concept and rationale behind imposing windfall taxes and maps the current scenario globally, with a focus on India. The paper also attempts to understand the possible role of windfall taxes in helping countries in achieving Sustainable Development Goals (SDGs), along with the prospective challenges.

2. Concept – What is a windfall tax?

A windfall tax can be defined as a higher tax rate on above average profits that result from a sudden windfall gain to a particular company or industry due to external and exceptional event (s). These are profits that cannot be attributed to something the firm actively did, like an investment strategy or an expansion of business. It is often due to unusual spikes in demand and/or interruptions to supply created due to geo-political disturbances, war, or natural disaster.

In the current scenario, the energy sector is benefitting from a one-off external situation – the Russia-Ukraine crisis – that they were not responsible for and were able to make windfall profits from. A windfall tax will tax these profits separately, over and above the normal taxes that these companies pay to the government.

Windfall tax is not a new concept and has been employed as a fiscal measure in the past by various governments as a result of dramatic increases in prices and profits in industries, specifically in oil markets where price fluctuations lead to volatile or erratic profits for the industry. Some notable instances include the 1970s OPEC oil embargo and the Persian Gulf wars. Another example is of the UK Conservative Party leader Margaret Thatcher imposing an extraordinary levy on the windfall profits of banks in 1981 that were making large margins on their loans due to very high-interest rates.

3. Rationale – why is a windfall tax levied?

The primary rationale behind the concept of windfall taxes is to capture above-average profits from players who earned them, perhaps inadvertently, at the cost of others to reinstate equilibrium in the economy through fiscal or policy measures.

Commodity prices for coal, oil, and natural gas have increased sharply during 2022, although prices have retreated somewhat more recently. This increase in price stems from multiple factors, key to which is a mismatch between energy demand and supply during the economic recovery from COVID-19, which is further amplified by the Russia-Ukraine crisis. While this surge in prices has boosted profits for the energy sector, it has also led to an increasing pressure on households and businesses in multiple parts of the world. The need to alleviate this pressure has sparked renewed policy interest internationally in the taxation of windfall profits in the energy sector as a means for raising revenue and providing support to the affected masses.

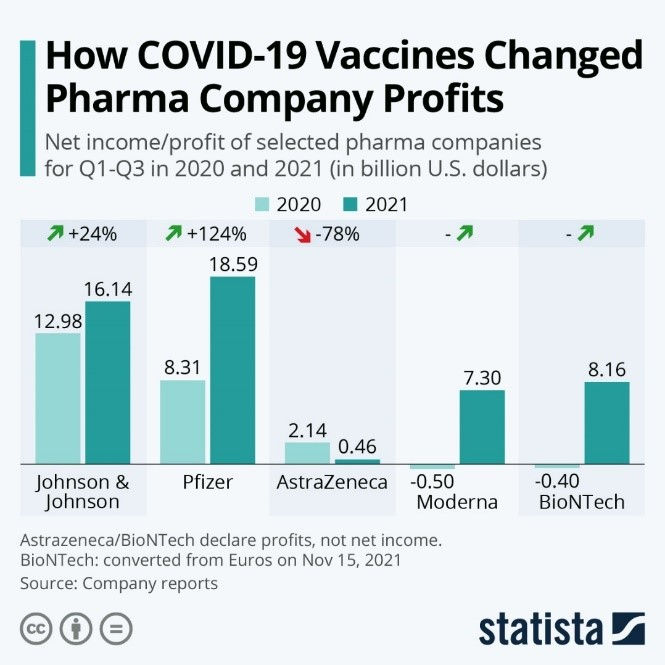

Figure 1: Impact of COVID-19 on pharma profits

Figure 2: Global fossil fuel prices (since 2019)

Oxfam has calculated that 1000 of the world’s biggest companies have recorded excess profits of 1.15 trillion dollars compared to the pre-pandemic period. This is an increase of 68.5 percent, with the largest share going to the financial, energy, and pharmaceutical sectors. Billionaires’ wealth has risen more since COVID-19 began than it has in the last 14 years put together and there are 600 more billionaires today compared to the pre-pandemic period. At the same time, 263 million more people could be pushed into extreme poverty in 2022, compared to pre-pandemic projections, due to the combined impact of COVID-19, inequality and food and energy price inflation – accelerated by the war in Ukraine. Inflation has reached its highest peak since 2008 globally with low-income countries and the poorest hit the hardest. A tax on the excess profits of big corporations in periods of crisis like the pandemic and the current energy and food crisis is not only fair but generates revenue for the governments that can be used for social welfare schemes, redistribution of gains, assist in reducing the trade deficit, etc.

Some of the key rationales for governments to impose windfall taxes globally include:

3.1. Redistribution of gains:

Windfall tax can help in redistribution of the unexpected gains by shifting profits from the companies who are profiteering off the global crises to ordinary people who are facing an increase in the cost-of-living. Windfall taxes ensure that no company can profit excessively from a period of immense economic and human suffering.

3.2. Funding social welfare schemes:

In addition to utilising funds to recompense people directly affected by the crises in the country, the government can also, based on the corpus collected, fund social welfare schemes and launch new programmes to benefit the citizens.

3.3. Supplementary revenue stream for the government:

A well-designed tax can provide government with additional stream of revenue without distorting investment and production decisions. It can also assist in reduction of a country’s trade deficit.

4. Possible challenges

4.1. Uncertainty in the system:

Since windfall taxes are influenced by unexpected events, they can create uncertainty in the system which may discourage capital investments by investors and companies. Additionally, this challenge can be exacerbated with the possibility of the tax being implemented retrospectively, i.e., taxes are imposed on transactions prior to the date of amendment.

4.2. Lack of clarity :

Situations where the duration of the windfall taxes and applicability of the given terms is not specified can create confusion for businesses and investors and further impact their decision making and future investments.

4.3. Difficulty in defining windfall profits :

In some situations, it can be difficult to distinguish between windfall profits and profits which are above-average are considered normal. For this purpose, it becomes essential to lay down what constitutes true windfall profits and how it can be determined what profit is normal or excessive.

5. Indian Scenario

5.1. Background

Following the Russia-Ukraine crisis, crude oil prices increased exceptionally leading to the country’s oil companies raking in super normal profits. The three upstream oil companies i.e., ONGC, Oil India, and GAIL declared all-time high net profits in the fiscal year 2022 when the international prices soared to a near 14-year high owing to the conflict. ONGC declared a record net profit of INR 40,305 crore in the fiscal year ended March 31 (258% increase from previous year’s net profits). Similarly, Indian Oil Corporation declared the highest ever revenue by an Indian corporate at INR 7.28 lakh crore in the fiscal financial year 2021-22.

With many refiners making major gains through fuel exports to countries in oil-deficit and preferring exports over domestic supplies, the government decided to impose windfall taxes and duties to keep a check on the constant supply of crude oil in the domestic market. The government mandated oil exporters to fulfil the Indian domestic oil demand first and levied windfall taxes on exports which indirectly makes exporting oil more expensive. Further, with India’s economy struggling with an incredibly high current account deficit (CAD) and weakening rupee increasing the value of imports, the windfall taxes would provide an additional stream of income and assist the government in bridging this gap.

5.2. Approach

India imposed a windfall tax on oil producers in July 2022 which would be reviewed fortnightly. Duties were imposed on the export of petrol, diesel and jet fuel (ATF), along with a special additional excise duty (SAED) levied on locally produced crude oil. The government also mandated that Indian exporters would have to sell 50 per cent of petrol and 30 per cent of diesel in the domestic market on total shipping bill. The tax shall be applicable to special economic zones (SEZ) and export-oriented units (EOU) as well.

On July 1 2022, a tax of Rs 23,250 per tonne was imposed on the sale of domestic crude along with an export duty of INR 6 per litre on petrol and Aviation Turbine Fuel (ATF) and INR 13 per litre on diesel. The following rates were then revised fortnightly bases on global oil and product price movements.

By mid-July, with international oil prices softening, the windfall taxes were revised and brought down to INR 17,000 per tonne on production of crude oil came down from to Rs 17,000 per tonne. Tax on petrol exports was scrapped. Tax on ATF exports came down Rs 4 per litre and on diesel exports reduced to Rs 11 per litre. Consequently, rates were revised based on hikes and softening of the international prices. Most recently, the tax on production of crude oil was INR 11,000 per tonne. The tax on ATF exports were reinstated to INR 3.5 per litre and on diesel exports was INR 12 per litre. The table below indicates the revised tax rates since the implementation of the windfall taxes.

Table 1: Windfall tax rates in India (Note: A tax of INR 6 per litre was imposed on petrol exports on July 1, which was removed on July 20)

5.3. Impact

If the taxes are continued for the full year, the windfall tax on crude production was estimated to generate a revenue of INR 65,600 crore and tax on export products INR 52,700 crore. As per reports, the tax on crude oil could provide the government with over INR 7,000 crore annually on domestic production of 30 million tonnes of crude oil.

While the measure is slated to benefit the government coffers, a report by Morgan Stanley said that a higher cess on domestic crude production for ONGC and OIL was a negative surprise and could also imply downside risks to earnings for the sector over the medium term, impacting the earnings of ONGC and Oil India by 36% and 24% respectively. As per Kotak Institutional Equities, the indefinite period of the new taxes could create uncertainty about government revenues and companies’ earnings. Additionally, with the imposition of exports taxes on SEZ units, there might be tax uncertainty on future investments.

6. Global Scenario

Economies globally have been affected by the pandemic and the inflation crisis caused by the Russian-Ukraine crisis which has led to multiple countries being in favour of taxing excess profits. Economists like the Nobel-Award winning Joseph Stiglitz and international organisations like the United Nations (UN) and International Monetary Fund (IMF) have called for a windfall tax. As discussed in detail in the previous section, India has taken the plunge as well and has imposed windfall taxes on its oil producers. Across the world, many countries are taking steps to implement windfall taxes and have introduced or announced new taxes or other fiscal mechanisms to capture windfall profits.

Recently, the European Commission (EU) has proposed and agreed upon a package of emergency measures to curb the rise in energy prices. The measures can be termed as windfall taxes in practice, but not in name. These measures are discussed in detail in further sections.

Italy was one of the first countries to introduce windfall taxes in March wherein a one-time tax of 25% (initially 10%) was imposed on energy companies. This includes producers and sellers of electricity, natural gas, and petroleum products. The tax applies to company profits that rose more than €5 million between October 2021 and April 2022 compared with the same period in the previous year. Greece imposed a 90% levy on the windfall profits earned by domestic power producers for the period October 2021-March 2022.

The United Kingdom introduced its energy profits levy with a sunset clause of 2025 wherein an additional 25% tax shall be imposed on oil and gas profits on top of existing taxes. The case for the United Kingdom is discussed in further detail in the upcoming section.

Some other countries did not only target the energy sector but also additional sectors like banking, telecom, etc. Hungary announced a temporary windfall tax for 2022 and 2023 on the extra-profits from energy companies wherein the tax applies on the revenue generated from the difference between world market oil prices and actual prices paid on imports of oil products from Russia with a 40% tax rate (the rate was 25% until the end of July 2022). Taxes are also imposed on the banking sector (8/10%), telecom sector (7%), and the retail sector (4.1%). Spain announced its windfall profits tax for extraordinary profits earned in 2022 and 2023 by electricity utility companies (1.2% tax on power utilities' sales) and the banking sector (4.8% on bank's net interest income and net commissions). They are currently assessing whether to extend the windfall taxes beyond two years.

Romania introduced an 80 percent windfall profits tax on additional revenue realised by electricity producers calculated on the monthly difference between the average selling price and 450 lei per megawatt hour. The tax was subsequently modified to apply to net revenue, taking account of costs. The government also adjusted the fiscal regime for natural gas, introducing a progressive tax of 15 percent to 70 percent on additional income on gas prices above 85 lei (about $18) per megawatt hour. Countries including Belgium, Germany and the Netherlands are considering introducing windfall taxes soon as well with discussions and planning underway.

Table 2: Global scenario of windfall taxes (Source: Oxfam Media Brief - the case for windfall taxes)

7. Achieving SDGs – role of windfall tax

Addressing world leaders at the UN General Assembly, UN Secretary General, António Guterres urged countries, especially rich countries, to tax windfall profits of fossil fuel companies to help countries harmed by the climate crisis and people who are struggling with rising food and energy prices.

Oxfam research shows that 90 percent windfall tax on the excess profits made by G7’s largest corporations during the pandemic could generate almost $430 billion. This could fully fund the shortfalls on all existing humanitarian appeals and a 10-year plan to end hunger, while also raising enough for a one-off payment of over $3,000 to the poorest 10 percent of the population of the G7 countries, to help cover the rising cost of living. According to another analysis, a 10 percent tax rate on windfall profits in 2020 in the EU would have generated 4.8 billion euros. If the rate was at 70 percent, the figure would be up to 35 billion euros!

A major reason behind well-intentioned programmes designed to achieve SDGs is lack of funding at a national and international level. Windfall taxes provide a mechanism to yield massive funding which can be used to help tackle the biggest challenges of our time, both in the short and long term and help in achieving the sustainable development goals (SDGs).

While the resources yielded through the medium of windfall taxes shall indirectly and directly play a role in the achievement of all the 17 SDGs, based on the current global scenario, projected estimates, and aligned goals, windfall taxes can especially be helpful in the achievement of the following SDGs:

Figure 3: Selected SDG's which can be impacted through implementation of windfall taxes

8. The Way Forward

Multiple countries and international organisations are proposing the imposition of windfall taxes and similar fiscal measures to fairly deal with the energy crisis and support the affected masses. However, currently the scope of the measure is short-term and industry specific. Additionally, the conversation around the role of windfall tax as a mechanism for supporting the achievement of SDGs is fairly sporadic and further research and dialogue is required in this area.

Some suggested methods to build windfall tax as a more permanent, effective, and useful mechanism in our economy such that it works towards global sustainable development have been outlined below:

8.1. Long-term policy focus:

It is essential to ensure that the taxation system is not ad-hoc and is built into the long-term policy of the government. In the long-term, work must be done at the global level to implement permanent windfall taxes that capture all excess profits and redistribute the revenues fairly to countries where companies have their real economic activity rather than funneling them away in tax havens.

The IMF recently suggested a permanent coordinated windfall tax that targets economic rents (defined as returns in excess of the opportunity cost of the investment – this means an amount of money earned that exceeds that which is economically necessary) and (b) based on the globally consolidated profit of multinationals (global profit of the entire group) allocated to countries according to sales.

8.2. Industry focus :

Currently, the windfall tax is primarily imposed on the energy sector, with some countries also levying charges on other sectors like banking, retail, etc. Countries need to be more ambitious and identify sectors earning super-normal profits wherein application of windfall taxes shall be appropriate. For instance, the pharmaceutical sector. Oxfam in its research mentioned a future of windfall tax which is ambitious, sector-wide and automatic. We could raise more than 1000 billion dollars globally with a tax of 90 percent on the windfall profit of 1000 of the world’s biggest companies!

8.3. SDG aligned utilisation of resources :

The resources mobilised through windfall taxed need to be utilised in a clearly stated direction and should be redistributed keeping the sustainable development goals in mind. The tax policy should support sustainability and due care should be taken if in some exceptional cases windfall taxes are imposed on renewable energy-based electricity generation, as it can be counterproductive. In adapting their tax policies to address the structural challenges they face, countries should put growth, equity and sustainability on an equal footing.

The role of the revenues generated through windfall taxes in helping achieve SDGs by assisting different areas of need have been outlined below.

8.4. Short term :

Windfall tax revenues can be channeled to those areas, countries, and people who are most affected by the crisis and require aid on an urgent basis. For instance, the Spanish government is using proceeds from the windfall tax in the country to finance free train tickets to address their cost-of-living crisis, provide grants to a million scholarship holders at schools and universities, and funding for 12,000 homes in Madrid.

8.5. Long term :

In the long-term, windfall tax revenues can help tackle the biggest challenges of our times like the explosion in inequality, the climate crisis, and the food security crisis. Proceeds can be used to not only respond i.e., fulfil commitments in terms of aid and addressing issues, but prepare – strengthening systems to enable countries and populations to be resilient.

9. Case Studies – Global Scenario of windfall tax

9.1 United Kingdom

A. Background

Owing to the soaring oil and gas prices globally, the oil and gas sector experienced extraordinary profits. However, the cost-of-living crisis in the UK was exacerbated due to the exceptionally high prices for gas and power, leading to the introduction of the energy profits levy. The levy does not apply to the electricity generation sector.

The measure was introduced in May 2022 and places an additional tax of 25% on the profits of oil and gas produced in the UK. The gains captured by the government shall go towards funding the cost-of-living crisis through subsidising of energy bills. The measure was introduced during the tenure of the previous prime minister and the current government has announced that it shall not impose further windfall taxes on the energy sector.

B. Approach

The UK’s new levy on the oil and gas sector consists of a 25% additional surcharge over the existing taxes on profits of 40%, which consists of a 30% corporation tax and 10% supplementary charge. This totals up the tax on profits to 65%. Companies shall not be able to offset previous losses against profits subject to the levy. The tax comes with a sunset clause i.e., the levy will cease at the latest by end of 2025, The government will phase out the levy sooner “if oil and gas prices return to historically normal levels”, however, these prices have not been specified as of yet.

However, this tax is accompanied by an “super-deduction” style investment allowance for any new investment in oil and gas extraction in the UK to encourage inflow of investments. As per this clause, producers can discount up to 80% of the capital and operating expenditure against the profits. This would mean that businesses will overall get a 91p tax saving for every £1 they invest, providing them immediate incentive to invest.

C. Impact

The government initially expected to raise £5 billion in the first year of the imposition of the energy profits levy. However, the latest government estimates put revenue from the levy roughly 50% higher at £7.7 billion for the 2022-23 fiscal year, with the figure set to exceed £10 billion the following year. The revenues are estimated to then reduce each year until the end of the 2025, when the sunset clause kicks in. The UK expects to raise £28 billion in the coming years from a windfall tax on oil and gas firms, as can be seen in the figure. However, it should be kept in mind that the total amount raised will depend on oil and gas market prices and shall take into account the repercussion of the investment allowance clause on the tax collection.

Figure 4: Projected revenue from windfall taxes in UK

9.2 European Commission

A. Background

While many countries have already introduced windfall taxes in their economies over the last few months, as discussed earlier in this research paper, the European Commission has only now reached an agreement regarding the emergency measures to address the high energy prices.

The price of electricity in EU is directly linked to the price of the gas, majority of which is imported. With disrupted supply, the gas prices have been soaring which in turn has impacted the prices of electricity. The regulation and measures agreed upon by EU energy ministers cover both common measures to reduce electricity demand and to collect and redistribute the energy sector's surplus revenues to final customers. This paper shall be focusing on the latter and shall detail EU’s take on windfall taxes.

Figure 5: Consumer electricity price trend in UK

B. Approach

The measures outlined by EU are essentially windfall taxes – in practise, if not in name. The measures are temporary in nature and shall be applicable from 1st December 2022 to 31st December 2023. The member states are allowed to introduce some flexibilities basis their circumstances which includes the possibility to:

Set a higher revenue cap

Use measures to further limit market revenues

Differentiate between technologies

Apply limits to market revenues of other actors including traders, among other things

The key fiscal measures consist of the following actions, in addition to the curbing electricity demand.

Capping revenues of electricity producers The market revenues for power producers, who do not use gas to generate electricity shall be capped at 180 euros/MWh. This includes electricity generator producing power with low operating costs using renewables, nuclear and lignite. The level of the cap has been set with the aim of preserving the profitability of the operators and avoid hindering investments in renewable energies.

Solidarity levy on fossil fuel sector A temporary solidarity contribution has been set on fossil fuel companies which includes businesses in the crude petroleum, natural gas, coal, and refinery sectors. The solidarity contribution would be calculated on excess profits, defined as profit exceeding the average of the last four years (2018 – 2021) by 20 percent. The solidarity contribution will apply in addition to regular taxes and levies applicable in member states.

C. Impact

EU ministers estimate that they can raise about €140bn (£123bn) from the levies on non-gas electricity producers and suppliers that are making larger-than-usual profits from the current demand. EU has proposed that the revenue collected should go towards supporting vulnerable people and companies to help them adapt to the increase in prices and invest in clean home-grown energy sources and decarbonisation technologies, like renewable energy. Revenue will be funnelled to consumers and companies to cushion the impact of high energy bills, and to invest in green energy. The EU members shall be required to collect revenues from aforementioned companies and redistribute them to hard-hit citizens and companies.

Figure 6: Methods of revenue utilisation by EU countries

Meet The Thought Leaders

Laboni Singh is a mentor at GGI and is currently working at The Bridgespan Group as an Associate Consultant. She takes keen interest in socioeconomic development issues, public policy, and equity across different vectors of gender, caste, class, and ability, which in turn fuelled her transition from working at a global bank to the social sector. She is an Urban Fellow from the Indian Institute for Human Settlements, Bangalore and has a bachelor's degree in Economics from St. Stephen's College, University of Delhi.

Meet The Authors (GGI Fellows)

Riya Aggarwal is an experienced consultant with a demonstrated history of working in the management consulting industry and the social infrastructure sector with a Bachelor's Degree in Management Studies from Shaheed Sukhdev College of Business Studies, University of Delhi.

If you are interested in applying to GGI's Impact Fellowship program, you can access our application link here.

References

The Guardian. 2022. A brief history of windfall taxes: who used them and why. [online] Available at: <https://www.theguardian.com/politics/2022/may/26/the-history-of-windfall-taxes-who-used-them-and-why>

Baunsgaard, T. and Vernon, N., 2022. Taxing Windfall Profits in the Energy Sector. IMF Notes. Washington, DC: International Monetary Fund

2022. Energy Profits Levy Factsheet - 26 May 2022. [online] Available at: <https://www.gov.uk/government/publications/cost-of-living-support/energy-profits-levy-factsheet-26-may-2022>

Freshfields Bruckhaus Deringer, 2022. Windfall Profit Taxes – do they work? [online] Available at: <https://www.freshfields.com/4a544f/globalassets/noindex/articles/tax-briefing---windfall_profit_taxes_sept-22.pdf>

Oxfam International. 2022. G7 must pursue windfall taxes on excess corporate 'pandemic profits' and cancel poor country debts to fund fight against hunger | Oxfam International. [online] Available at: <https://www.oxfam.org/en/press-releases/g7-must-pursue-windfall-taxes-excess-corporate-pandemic-profits-and-cancel-poor>

Mudgill, A., 2022. Here's how windfall tax will impact Reliance, ONGC and OIL India. [online] The Economic Times. Available at: <https://economictimes.indiatimes.com/markets/stocks/news/heres-how-windfall-tax-will-impact-reliance-ongc-and-oil-india/articleshow/92651665.cms?from=mdr>

The New Indian Express. 2022. IOC posts highest revenue by any Indian co, record profit in FY22. [online] Available at: <https://www.newindianexpress.com/business/2022/may/17/ioc-posts-highest-revenue-by-any-indian-co-record-profit-in-fy22-2454686.html>

OECD, 2021. Tax and Fiscal Policies after the COVID-19 Crisis. OECD Report for the G20 Finance Ministers and Central Bank Governors. [online] Italy. Available at: <https://read.oecd-ilibrary.org/view/?ref=1112_1112899-o25re5oxnb&title=Tax-and-fiscal-policies-after-the-COVID-19-crisis>

2022. ONGC - Financial Results - en - ongcindia.com. [online] Available at: <https://ongcindia.com/web/eng/about-ongc/performance/financial/results>

Zee Business. 2022. ONGC reports highest net profit of Rs 40,306 cr; becomes India's 2nd most profitable firm. [online] Available at: <https://www.zeebiz.com/companies/news-ongc-q4fy22-results-company-posts-31-jump-in-profit-on-high-oil-gas-prices-185828>

OXFAM, 2022. Oxfam Media Brief: the case for windfall taxes. [online] Available at: <https://oi-files-d8-prod.s3.eu-west-2.amazonaws.com/s3fs-public/2022-09/2022%20-%2009%20-%2008%20Windfall%20Tax%20Briefing.pdf>

OXFAM, 2022. Will the G7 rise to the Challenge of a World in Crisis? [online] Available at: <https://www.oxfamitalia.org/wp-content/uploads/2022/06/Report-Will-the-G7-rise-to-the-Challenge-of-a-World-in-Crisis_24_6_2022.pdf>

Store, J., 2022. Council agrees on emergency measures to reduce energy prices. [online] Consilium.europa.eu. Available at: <https://www.consilium.europa.eu/en/press/press-releases/2022/09/30/council-agrees-on-emergency-measures-to-reduce-energy-prices/>

Sdgs.un.org. THE 17 GOALS | Sustainable Development. [online] Available at: <https://sdgs.un.org/goals>

ETAuto.com. 2022. Tax on windfall profit on crude oil, export of diesel, ATF hiked - ET Auto. [online] Available at: <https://auto.economictimes.indiatimes.com/news/oil-and-lubes/tax-on-windfall-profit-on-crude-oil-export-of-diesel-atf-hiked/94884399>

The Guardian. 2022. Windfall tax on Covid profits could ease ‘catastrophic’ food crisis, says Oxfam. [online] Available at: <https://www.theguardian.com/world/2022/jun/27/windfall-tax-on-covid-profits-could-ease-catastrophic-food-crisis-says-oxfam> [Accessed 18 October 2022].

Aljazeera.com. 2022. UN chief calls for energy windfall taxes to help climate victims. [online] Available at: <https://www.aljazeera.com/news/2022/9/20/un-chief-calls-for-energy-windfall-taxes-to-help-climate-victims>

National Defence Institute. 2022. What is windfall tax and why are countries imposing it on the energy sector right now? [online] Available at: <https://nationaldefenceinstitute.in/article/what-is-windfall-tax-and-why-are-countries-imposing-it-on-the-energy-sector-right-now->

WION. 2022. What is windfall tax? Oxfam says tax of $490bn on Covid profits could ease food crisis. [online] Available at: <https://www.wionews.com/world/what-is-windfall-tax-oxfam-says-tax-of-490bn-on-covid-profits-could-ease-food-crisis-492314>

Moneycontrol. 2022. Windfall tax: Everything you need to know, and what next. [online] Available at: <https://www.moneycontrol.com/news/business/mc-explains-windfall-tax-everything-you-need-to-know-and-what-next-9284431.html>

Comments